Fitness & Health

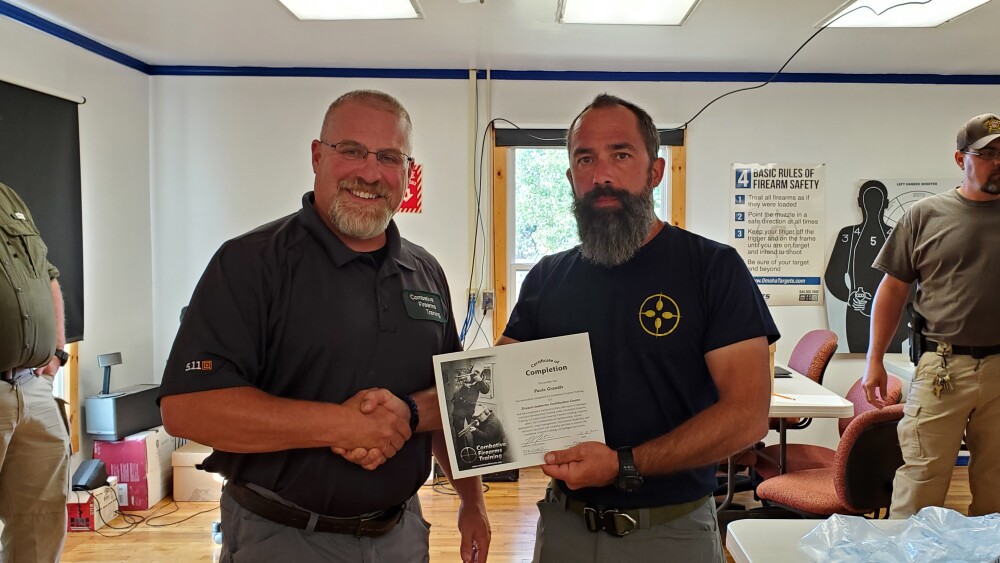

Firearms instructor Todd Fletcher went from a competitive power lifter to a retiree managing pre-diabetes and high blood pressure, showing the impact of shift work on wellness

COMPLETE COVERAGE

Firearms instructor Todd Fletcher went from a competitive power lifter to a retiree managing pre-diabetes and high blood pressure, showing the impact of shift work on wellness

From smartwatches to hydration, here are four mission-ready picks to help you build strength, regulate stress and stay fit for the job — and for life

We also know walking provides tremendous benefits for physical health, but does our step count really matter?

With more than 160 people still missing after deadly Hill Country floods, Texas search teams face the emotional toll of recovering bodies while managing the mental strain of their work

Score discounted duty gear, workout tools and everyday essentials July 8-11 with our curated list of budget-friendly buys

From burns to bleeding, head trauma to amputation, be prepared for when fireworks go wrong

MultiCare and Spokane Fire Department responded to 892 total incidents during the basketball tournament, down from nearly 1,200 last year

A paramedic’s sudden death prompts urgent questions about operational norms and caregiver health

A practical guide to interpreting urine color for maintaining optimal hydration

Nearly 60% of leaders cited documentation as a critical concern impacting billing, compliance and patient care, according to a report by the PWW Advisory Group and AIMHI

MOST POPULAR

- Do something different: Why it’s time to question everything about recruitment

- Insider analysis: Kentucky paramedic’s death reignites debate on EMS shift culture

- ‘Not up to industry standards': Conn. officials plan to relocate city EMS to better quarters

- Ask Laurie: How can I become more resilient at work?

- ‘Definitely a “no-confidence” feeling': Honolulu EMS director’s leadership questioned, making future uncertain